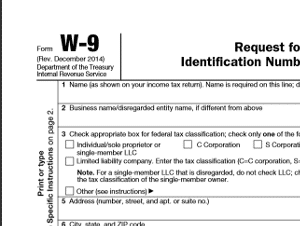

Form W-9

The Inland Revenue Service does not use Form W-9 – in fact you have to send it to someone for whom you will be working. It’s a way of potential employers (or people hiring you for contract labor more specifically) to get your Taxpayer ID – this is your Social Security Number if you are an individual.

The person who is requesting a W9 Form from you will then report how much money they’ve paid to you, and if you file an income tax return, they’re going to tally the numbers you give with the numbers given by the people who paid you. Simple right?

Why Fill in the W9 Form?

If you don’t fill in a W9 then the payer may be required to withhold probable taxes from what they pay you. So you can’t get out of paying taxes by not filling it in.

What happens if I’m a US citizen living outside the US?

If you’re a US citizen, then you pay US taxes for the most part. So you have to participate in FATCA.

what form do I need my sister passed away and I am her excective for her will

my sister Shirley Byram passed away May 29,2015 and I need the form to open an estate account. I am her execectivor to her will.

I’m sorry to hear that. I would contact a probate lawyer in the first instance.

my sister Shirley Byram passed away May 29,2015 and I need the form to open an estate account. I am her execectivor to her will. Can you tell me the form number I need?