Do Non- Resident US Citizens Qualify for the COVID-19 Stimulus Rebate?

If you’re a US taxpayer (e.g. a US citizen) who is non-resident in the US for tax purposes, do you still get the Covid-19 Stimulus payment in 2020? This is a question very dear to me, as I live in the UK, am a US citizen and file US tax returns each year. It’s a major and expensive pain on an annual basis. But will I get the stimulus payment?

I’m a Non-Resident US Citizen – Did I Get Paid?

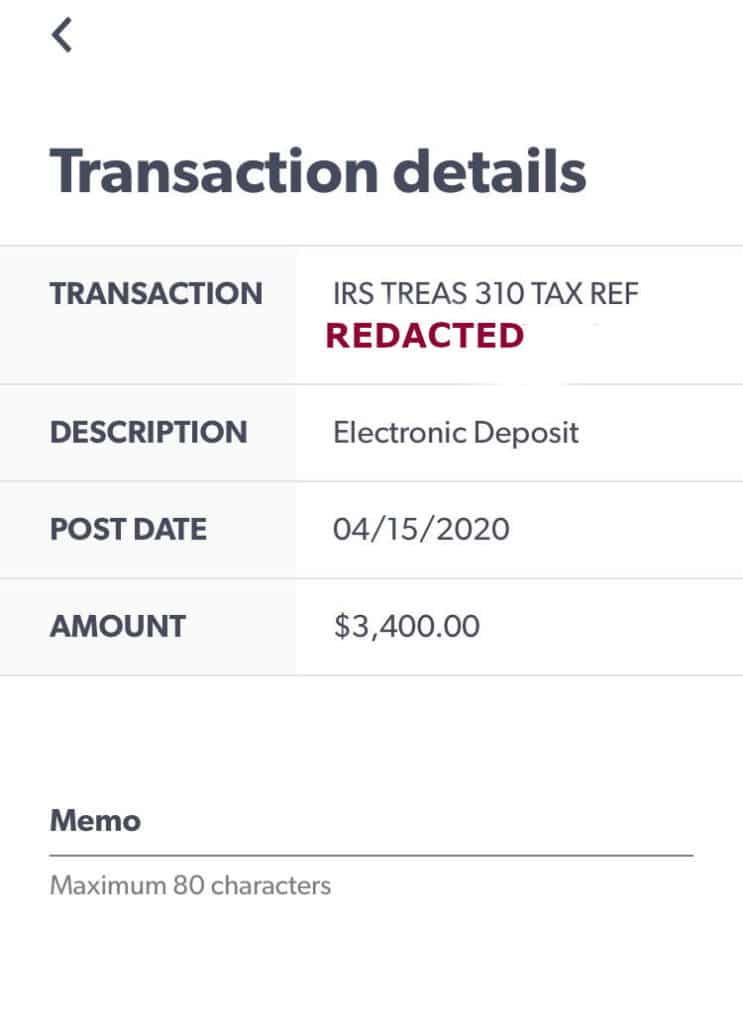

The short answer is, YES. Since the IRS have my bank account details and used them to make an repayment of overpaid estimated taxes a few years back, I found $3,400 in my bank account on April 15th 2020. $1,200 for my wife, $1,200 for me, and $500 each for our two children.

I was a little surprised and thoroughly expected that it was received in error, so I took a deep dive into the CARES Act to see if I would have to repay it.

What Does the CARES Act say?

The CARES Act is a dry read at best, and here’s the relevant section:

SEC. 2101. 2020 RECOVERY REBATES FOR INDIVIDUALS.

(a) In General.—Subchapter B of chapter 65 of subtitle F of the Internal Revenue Code of 1986 is amended by inserting after section 6427 the following new section:

SEC. 6428. 2020 RECOVERY REBATES FOR INDIVIDUALS.

(a) In General.—In the case of an eligible individual, there shall be allowed as a credit against the tax imposed by subtitle A for the first taxable year beginning in 2020 an amount equal to the lesser of—

(1) net income tax liability, or

(2) $1,200 ($2,400 in the case of a joint return).

The Act goes on to describe what a taxpayer is (there’s a minimum $2,500 income and other verbiage), and then to talk about who isn’t eligible:

(3) ELIGIBLE INDIVIDUAL.—The term ‘eligible individual’ means any individual other than—

(A) any nonresident alien individual,

(B) any individual with respect to whom a deduction under section 151 is allowable to another taxpayer for a taxable year beginning in the calendar year in which the individual’s taxable year begins, and

(C) an estate or trust.

Summary

So in summary, you don’t need to be physical resident according to the Act – just a taxpayer. As a non-resident citizen, I got my rebate.

Leave a Reply